India’s Quick-Commerce Sector Faces Growth Challenges, Blume Venture’s Report Reveals

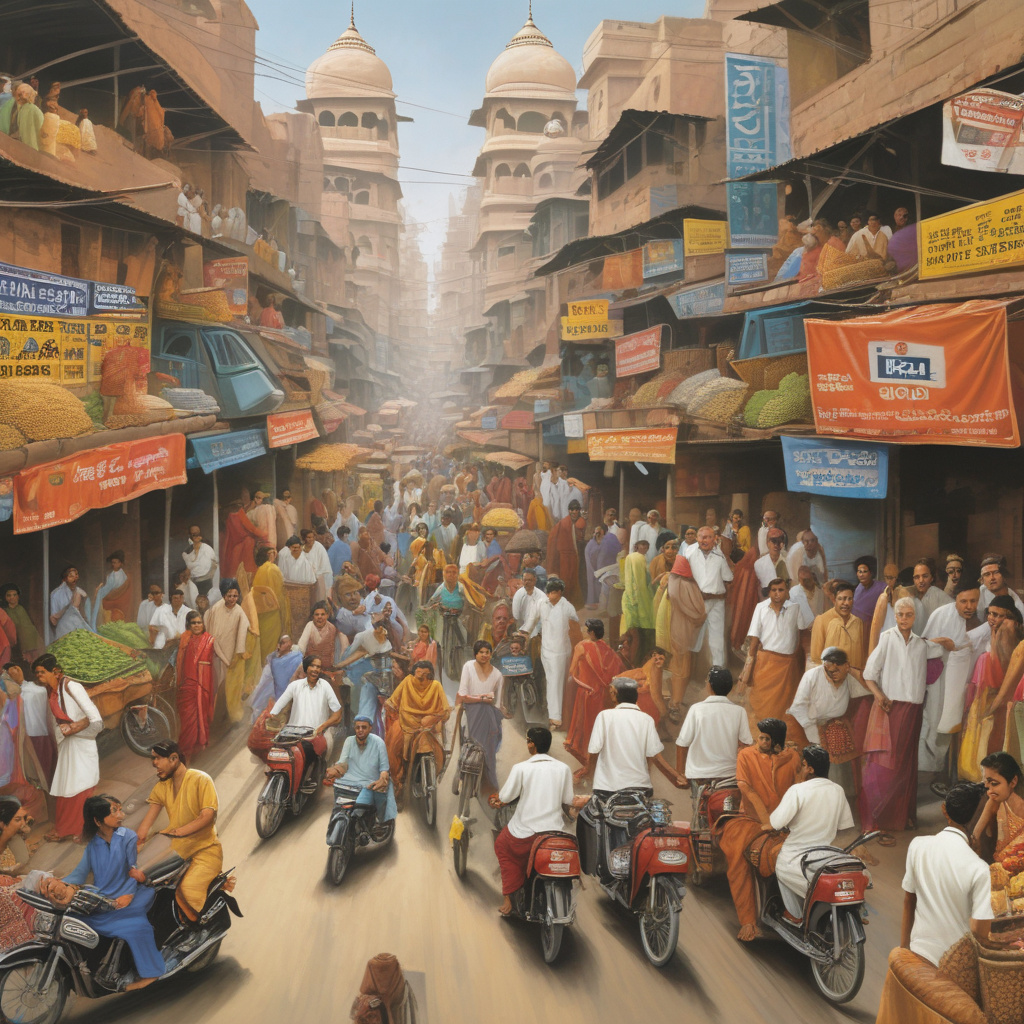

India’s quick-commerce sector has witnessed remarkable growth, soaring to a substantial $7.1 billion market in recent years. However, according to a recent report by Blume Ventures, the industry’s momentum may soon encounter significant challenges that could hinder its ability to sustain this rapid expansion. As the quick-commerce landscape evolves, various factors threaten to stifle its growth trajectory, including limited geographical expansion, intense competition from established e-commerce giants, and potential regulatory scrutiny.

One of the primary obstacles facing the quick-commerce sector is its reliance on major urban centers. While cities like Bengaluru, Mumbai, and Delhi have embraced the convenience of rapid delivery services, the penetration of quick-commerce in smaller towns and rural areas remains limited. This confinement to metropolitan areas not only restricts the customer base but also poses a risk of saturating the market in these regions. With a significant portion of India’s population residing outside these major cities, the industry’s growth potential in untapped markets remains largely unrealized.

Additionally, the competitive landscape is becoming increasingly fierce as larger e-commerce players, such as Amazon and Flipkart, continue to enhance their delivery capabilities. These established companies possess vast resources, extensive logistics networks, and brand recognition, enabling them to adapt quickly to changing consumer preferences. As they enter the quick-commerce arena, smaller players may find it challenging to maintain their market share and carve out a sustainable niche in this crowded space.

Blume Ventures’ report highlights another pressing issue: the possible tapering of growth in monthly transacting users. As the novelty of quick-commerce wears off and consumers return to their pre-pandemic shopping habits, the sector may witness a slowdown in user engagement. This phenomenon is not unique to India; similar trends have been observed in other markets, where the initial spike in usage during the pandemic has not been sustained. Quick-commerce companies must now develop strategies to retain existing users and attract new ones, which may require significant investment in marketing and customer retention efforts.

Moreover, the looming specter of regulatory scrutiny is another factor that quick-commerce companies must navigate. As the sector grows, it inevitably attracts the attention of regulators who may impose new rules and guidelines to ensure consumer protection and fair competition. Such regulations could create additional operational hurdles for quick-commerce platforms, potentially leading to increased costs and compliance challenges. Companies that fail to adapt quickly to these regulatory changes may find themselves at a competitive disadvantage in an already challenging market.

To overcome these hurdles, players in the quick-commerce sector need to innovate and diversify their offerings. Expanding service areas beyond metropolitan regions could open new revenue streams and broaden the customer base. Additionally, companies can explore partnerships with local businesses to enhance their delivery capabilities and improve brand visibility in smaller towns. By leveraging technology and data analytics, quick-commerce platforms can gain insights into consumer behavior, enabling them to tailor their services to meet specific regional demands.

Moreover, investing in customer loyalty programs may prove beneficial in retaining users and fostering repeat business. By offering incentives such as discounts, promotions, and personalized experiences, companies can encourage customers to choose their services over competitors. Fostering a sense of community around the brand can also build customer loyalty and drive long-term growth.

In conclusion, while India’s quick-commerce sector has experienced impressive growth, the future may not be as bright without strategic adjustments. The challenges posed by limited geographic reach, fierce competition, potential user decline, and regulatory scrutiny necessitate a proactive approach. Companies that can adapt to this evolving landscape by innovating their business models and expanding their market presence may still find opportunities for success in this dynamic industry.

quickcommerce, India, e-commerce, businessgrowth, retail